- +91 8169745890

-

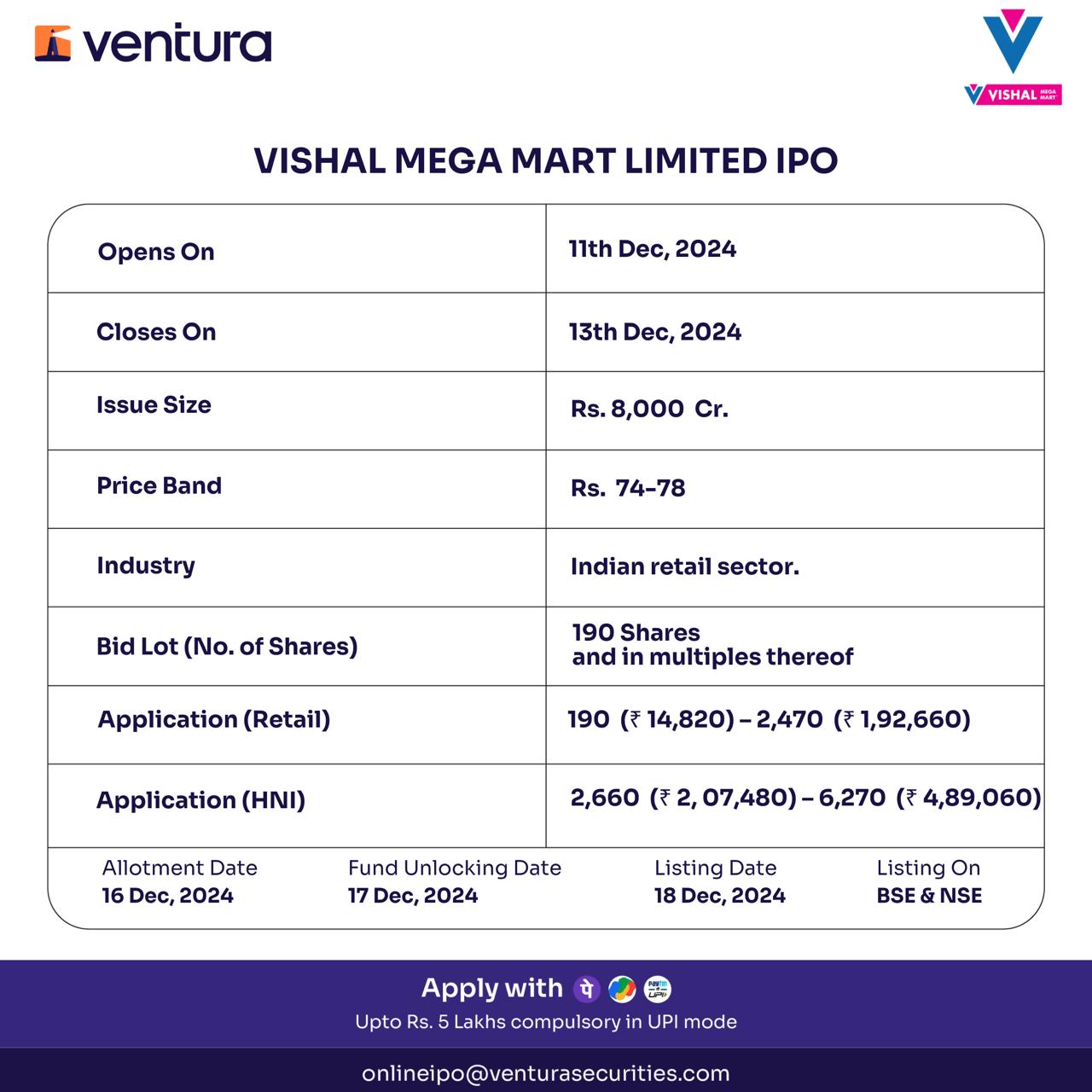

Established in 2001, Vishal Mega Mart is a leading hypermarket chain in India offering a diverse range of products, including apparel, groceries, electronics, and home essentials.

Targeting middle and lower-middle-income groups, Vishal Mega Mart operates through a pan-India network of 645 stores, supported by its mobile app and website. The company has a presence in 414 cities across 28 states and two union territories, making it one of India’s top two offline-first diversified retailers.The company has a presence in 414 cities across 28 states and two union territories, making it one of India’s top two offline-first diversified retailers.

The company follows an asset-light business model, leasing all its stores and distribution centers while sourcing products from third-party vendors. Its direct local delivery service, managed by company employees, serves 6.77 million registered users across 600 stores in 391 cities in India.The company employs 16,537 people as of the same date.

Vishal Mega Mart’s in-house brand portfolio spans across key categories to meet diverse consumer needs. Its technology driven operations and systematic processes ensure smooth and efficient business functioning.

Apply Now!

Tags : IPO,

Started our journey back in 2008 with a goal of helping people grow their wealth as well as protect it. Catering to 400+ clients locally and internationally, Fine Investments is a one stop shop for all your financial investment needs.

Office No. 705, A-wing, AUM Avenue, MG Road, Near Ambaji Dham Mandir, Mulund West, Mumbai 400080

+91 8169745890

+91 8454941139

Copyright © Fine Investments. All rights reserved.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-60554 | Date of initial registration ARN – 03-Dec-2010 | Current validity of ARN – 09-Apr-2028

Grievance Officer- Hitesh Shah | hitesh.fineinvestments@gmail.com

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors